How to Keep Compliant with International Regulation While Pursuing Offshore Investment

How to Keep Compliant with International Regulation While Pursuing Offshore Investment

Blog Article

Exactly How Offshore Investment Functions: A Step-by-Step Break Down for Financiers

Offshore investment provides a structured path for capitalists seeking to enhance their economic strategies while leveraging worldwide chances - Offshore Investment. The process begins with the mindful selection of a territory that aligns with a financier's objectives, followed by the establishment of an account with a qualified offshore establishment. This methodical strategy not only enables portfolio diversity yet also demands ongoing administration to browse the intricacies of global markets. As we check out each action in detail, it comes to be apparent that recognizing the nuances of this financial investment approach is vital for achieving optimal outcomes.

Recognizing Offshore Investment

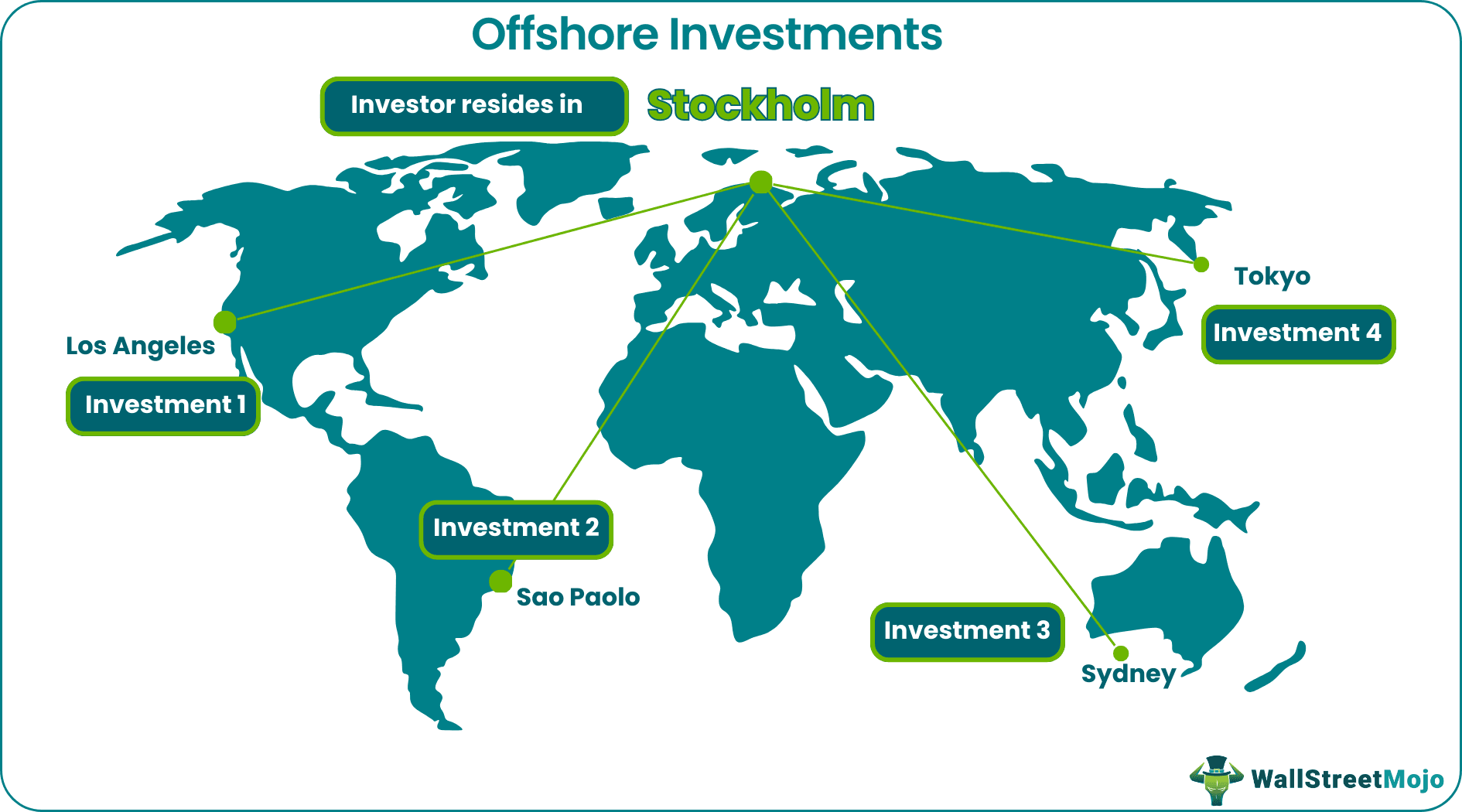

Recognizing offshore financial investment includes acknowledging the strategic benefits it provides to people and companies looking for to enhance their economic portfolios. Offshore financial investments usually describe possessions kept in an international territory, typically characterized by positive tax obligation routines, governing environments, and privacy protections. The primary intent behind such financial investments is to improve capital development, diversity, and threat administration.

Investors can access a broad variety of economic tools via overseas venues, including stocks, bonds, shared funds, and realty. These financial investments are usually structured to abide by local laws while offering versatility in regards to property appropriation. Additionally, overseas financial investment techniques can allow individuals and companies to hedge versus domestic market volatility and geopolitical dangers.

An additional secret element of overseas financial investment is the capacity for enhanced personal privacy. A complete understanding of both the commitments and benefits linked with overseas investments is crucial for notified decision-making.

Benefits of Offshore Spending

Investors usually turn to offshore spending for its various benefits, including tax obligation efficiency, property security, and profile diversity. Among the primary advantages is the capacity for tax obligation optimization. Numerous offshore territories offer beneficial tax obligation regimens, allowing financiers to legitimately lower their tax obligations and optimize returns on their financial investments.

Additionally, offshore accounts can supply a layer of property defense. Offshore Investment. By positioning assets in politically stable jurisdictions with strong privacy legislations, financiers can guard their wide range from potential legal claims, lenders, or financial instability in their home nations. This kind of protection is particularly appealing to high-net-worth individuals and business owners encountering lawsuits risks

Furthermore, offshore investing helps with portfolio diversification. Accessing worldwide markets enables financiers to check out possibilities in various asset classes, including property, stocks, and bonds, which may not be offered locally. This diversification can reduce general profile danger and boost possible returns.

Inevitably, the advantages of overseas investing are engaging for those looking for to enhance their monetary techniques. It is important for investors to completely understand the effects and regulations linked with offshore financial investments to ensure conformity and achieve their monetary objectives.

Selecting the Right Territory

Picking the suitable territory for offshore investing is a critical decision that can significantly affect a capitalist's financial method. The right territory can give various benefits, consisting of positive tax obligation structures, property protection legislations, and governing environments that line up with a capitalist's objectives.

When selecting a jurisdiction, take into consideration elements such as the political security and financial health of the country, as these aspects can affect investment safety and returns. Furthermore, the legal framework bordering international financial investments need to be examined to make sure conformity and defense of assets. Countries understood for robust legal systems and transparency, like Singapore or Switzerland, typically impart higher confidence among financiers.

Furthermore, evaluate the tax implications of the jurisdiction. Some countries offer eye-catching tax obligation motivations, while others might impose strict reporting requirements. Understanding these subtleties can aid in enhancing tax liabilities.

Steps to Establish an Offshore Account

Establishing an overseas account entails a series of systematic steps that make sure compliance and safety. The first action is picking a trustworthy offshore banks, which must be licensed and controlled in its official statement territory. Conduct comprehensive study to assess the organization's reliability, solutions provided, and client testimonials.

Next, gather the needed documentation, which usually consists of recognition, proof of address, and information pertaining to the resource of funds. Various territories may have varying demands, so it is critical to validate what is needed.

Once the paperwork is prepared, start the application procedure. This might entail filling out forms online or face to face, depending upon the establishment's methods. Be planned for a due diligence process where the bank will verify your identity and assess any potential risks related to your account.

After approval, you will receive your account details, allowing you to fund your offshore account. It is advisable to maintain clear documents of all purchases and abide by tax obligation laws in your house nation. Developing the account appropriately establishes find more the structure for reliable overseas investment monitoring in the future.

Handling and Monitoring Your Investments

Once an offshore account is effectively established, the focus changes to taking care of and checking your investments effectively. This critical phase entails a methodical strategy to ensure your properties align with your monetary goals and run the risk of resistance.

Begin by developing a clear financial investment technique that describes your objectives, whether they are capital conservation, earnings generation, or growth. Frequently evaluate your profile's performance against these standards to evaluate whether adjustments are required. Utilizing economic administration tools and systems can help with real-time monitoring of your investments, providing understandings into market fads and asset allocation.

Involving with your offshore monetary advisor is crucial. They can provide proficiency and advice, assisting you browse complicated international markets and regulative environments. Set up regular testimonials to talk about efficiency, assess market problems, and rectify your technique as essential.

Furthermore, continue to be notified concerning geopolitical developments and financial indications that may influence your investments. This proactive technique enables you to respond promptly to altering circumstances, guaranteeing your offshore portfolio stays durable and aligned with your financial investment goals. Eventually, diligent administration and recurring monitoring are necessary for maximizing the benefits of your offshore financial investment strategy.

Final Thought

To conclude, overseas investment offers a critical opportunity for profile diversity and risk management. By engaging and choosing a proper jurisdiction with trusted monetary establishments, capitalists can browse the intricacies of global markets properly. The organized strategy laid out makes certain that capitalists are well-appointed to maximize returns while sticking to legal frameworks. Continued monitoring and collaboration with financial experts remain essential for maintaining an agile investment method in an ever-evolving worldwide landscape.

Offshore investment presents an organized path for financiers looking for to maximize their economic approaches while leveraging worldwide opportunities.Understanding overseas financial investment includes recognizing the calculated advantages it offers to people and firms looking for to maximize their financial profiles. Offshore investments usually refer to assets held in an international jurisdiction, usually identified by favorable tax obligation routines, content regulatory environments, and privacy securities. Furthermore, overseas investment methods can allow people and services to hedge against residential market volatility and geopolitical dangers.

Report this page